FROM EMERGING TO LEADING: WHY BRAZIL

IS REINVENTING FINANCIAL INNOVATION

Learn from this Report

Brazil Unlocked: The Next

Frontier in Financial Innovation

The Hidden Trillion Dollar

Gap in SME Credit

From Traditional to Tokenized:

Rethinking Private Credit

Brazil Rising: Early Signals

from a Market Already

Built for Scale

Momentum That Matters:

Brazil’s Regulatory

and Institutional Advantage

From Outlook to

Opportunity: Scaling

Brazil’s Next Chapter

Brazil’s Strategic Imperatives:

A Stakeholder’s Guide

The Future is Tokenized:

Blockhain For Brazil

We invite you to explore a unique and profound read on private credit

investments opportunities prepared by the lead industry experts in Brazil.

THE AUTHORS

THE SPONSOR

THE writer

Claudia Mancini

EXPERIENCE THE RESHAPE

IN PRIVATE CREDIT ACCESS

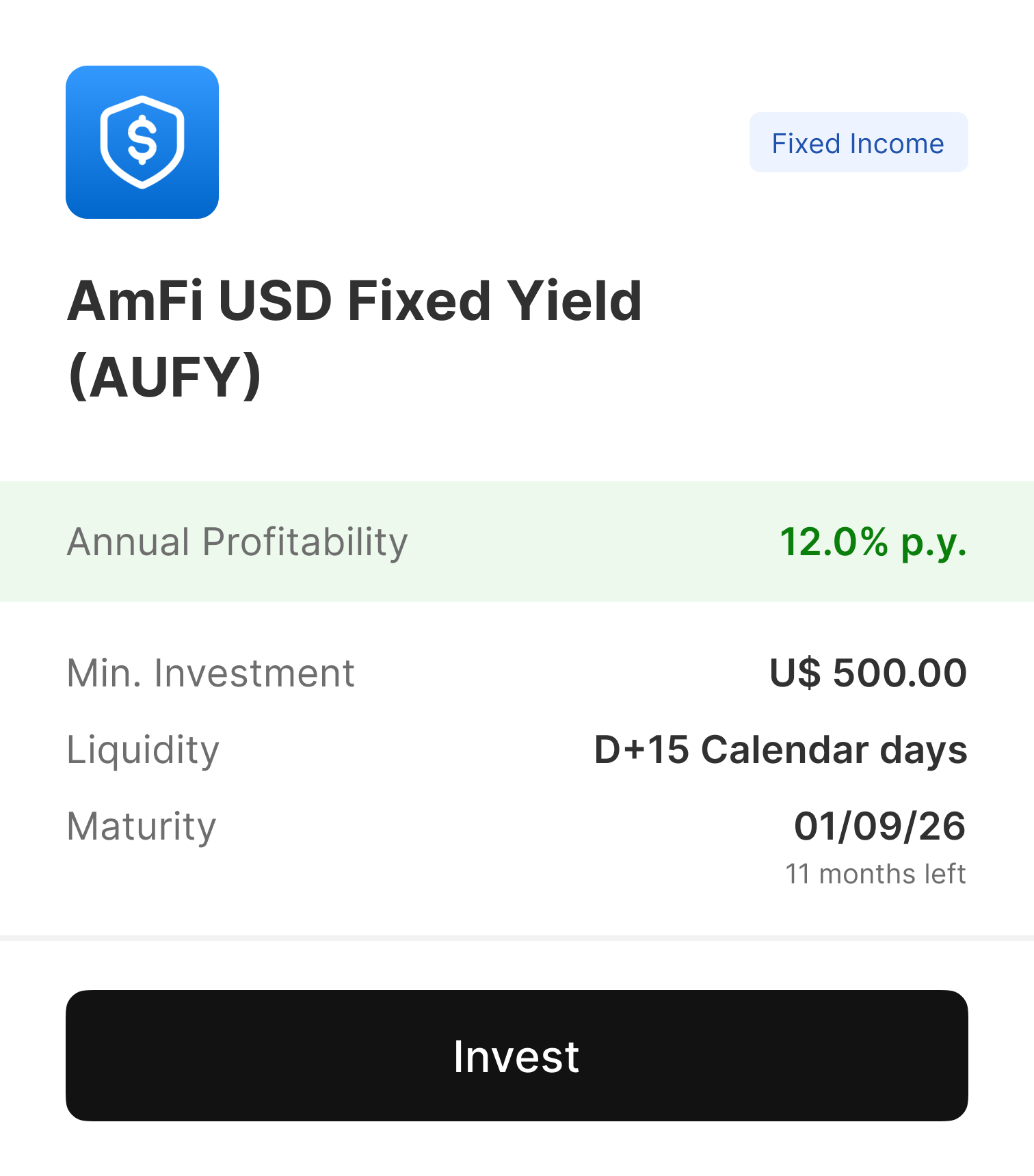

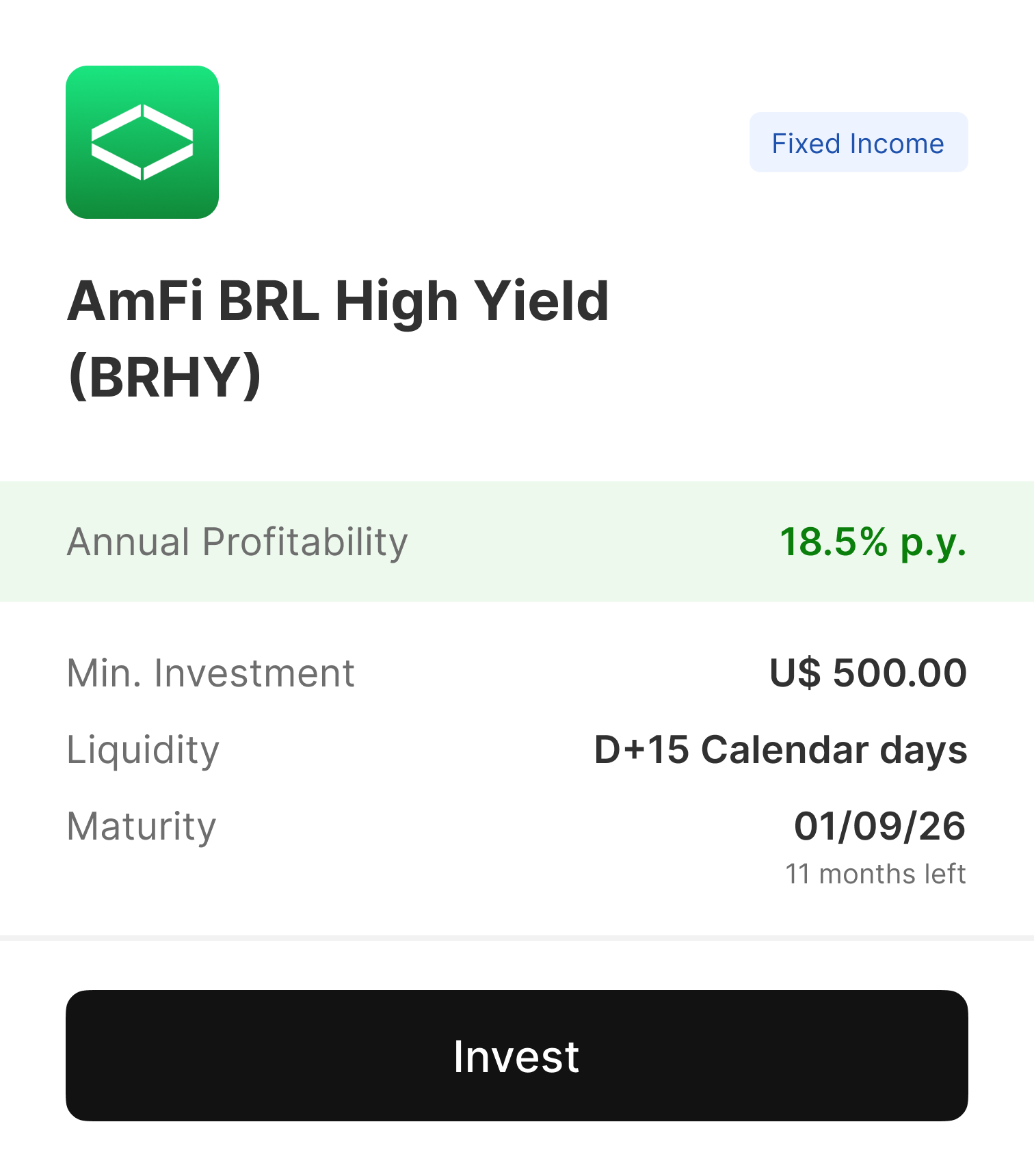

BRAZIL IS ALREADY DEPLOYING TOKENIZED CREDIT PRODUCTS

Brazil is already deploying groundbreaking tokenized credit products

A bold legacy of innovation makes Brazil uniquely investment-ready

Capital access is a structural opportunity, not a temporary challenge

World-class regulators are not observers — they are active catalysts for growth

Brazil’s dynamic private credit market is set to become a global benchmark

OPEN UP FOR INNOVATION

AMFI IS BUILDING THE BLOCKS FOR NEW FRONTIERS FOR GLOBAL MARKETS WITH TOKENIZATION

ABOUT AmFi

AmFi is a leading tokenization platform in Brazil focused on private credit. It enables investors to access high-quality credit assets through programmable and compliant tokenized structures. As one of the earliest companies to build legal, technical, and operational frameworks for tokenized debt in Brazil, AmFi plays a central role in advancing the country’s asset tokenization ecosystem.

This publication is not intended for investment purposes.